Recent news of

BARNES

15/05/2019

However, the economic and political climate can influence this market in certain countries and regions in the world. In the short to medium term, timing therefore remains crucial.

In Europe, Brexit is the great unknown for 2019. Its consequences are still difficult to measure, but it is indisputable they will result in a major reshuffling of the deck in terms of sales and purchases, both in Great Britain and continental Europe. In the United States, Donald Trump’s presidency, which has been accompanied by a net economic upturn, cannot mask a certain nervousness among economic actors.

The key for 2019 will be the FED's rate-setting policy. In Asia, Japan returned as a driving force after being hit hard by the Fukushima tsunami in 2011. And in 2018, Vietnam confirmed its arrival into the luxury real estate market. But observers have their eyes firmly fixed on Hong Kong, whose dynamism appears to be limitless…

In Europe, the real estate sector has been positive but prudent, in line with overall growth across the continent, which demonstrated its robustness between 2016 and 2017. The European Union grew by 2.5% in 2017 - its strongest performance since 2007, when it increased by 2.7%. GDP rose by 2.2% both within the Eurozone and the EU28 during the second quarter of 2018, following on from +2.5% and +2.4% growth respectively in the fi rst quarter of 2018.

The outlook for the European economy remains positive overall following a marked improvement in 2017, although growth has slowed slightly since the start of 2018. The true upturn could be yet to come, even though internal political tensions are emerging in Italy, France and Germany.

The increasingly hard stance taken by the United States on trade could prove damaging economically, just as Brexit could hurt the United Kingdom for a long time to come. The outlook for growth in the short term will therefore be determined in large measure by the approach taken by the region's central banks

Europe's relatively good economic health was buoyed by the German, French, Italian and Spanish economies. However, for European real estate professionals, it is diffi cult to move beyond the persistent uncertainty surrounding Brexit, which will take eff ect on 30 March 2019.

The stagnation of the British economy, allied with a slower stock market growth rate and a fall in real estate values in the order or 25% in three years, has led the United Kingdom to post average performances in 2017. Paradoxically, this is turning out to be a source of opportunity: with growth falling, Asian investors - who are less bothered by Brexit than their European counterparts - are taking a long-term approach in placing their capital in London.

According to data published by Real Capital Analytics, in 2017, the UK capital was the European city with the highest volume of non-European investment in real estate.

Although it is diffi cult to predict the consequences of the “gilets jaunes” (yellow vests) movement in the medium and long term, it appears that France, and Paris in particular, is the biggest beneficiary of the hesitation observed in London. This has led to a direct increase in prices in the most soughtaft er Parisian neighbourhoods such as Saint-Germain-des-Prés and the Marais area.More unexpectedly, this new clientèle with its cosmopolitan culture has no qualms about buying in hitherto neglected arrondissements in the north-east of Paris, such as the 10th and 11th. The €10,000/sq. m. bar in Paris as a whole is therefore set to be raised in 2019 with increasingly regular transactions above €20,000/sq. m. for luxury properties.

This renewed interest in Paris (and its western suburbs) is being replicated in Provence and the Côte d’Azur, two regions renowned both for their climate and their dynamic economies, as well as for the excellence of their international schools and universities. Another big benefi ciary on the new European luxury real estate map, Portugal, is attracting former expatriates living in the United Kingdom and buyers seeking a main family residence or investors drawn by high rental returns in cities such as Lisbon and Porto.

With prices per sq. m. up 5-fold in the space of a few years for the top properties, the €10,000/ sq. m. bar is now commonly being crossed. Major wealth gains have moreover been recorded in the majority of non-Euro countries. In Switzerland, double-digit growth in the net value of the fortunes of UHNWI (+15% at USD 877 billion) has highlighted the general upturn in activity on European financial markets, while strong growth recorded in Russia and Norway has been supported by the rise in global oil prices.

The United States easily rank first among countries with the most HNWI and UHNWI. However, its dominance is tending to wane due to pressure from the Asian continent. Although their number has increased less rapidly than in China, France or Canada in 2017, the United States is still by far the country with the most UHNWI. Indeed, they number 79,595, i.e. a third of their total number worldwide, compared with 17,915 for the 2nd country on the podium, Japan.

Sustained economic activity, a resistant dollar, high-performing financial and technological sectors and tax incentives implemented by the Trump administration have enabled the number of UHNWI in the US to increase by 8.9% in 2017. Despite the recent (and so far slight) increase in interest rates by the Federal Reserve, US financial markets continued to rise in 2017-2018, resulting in the tenth successive year of wealth creation.

The prospect of an increase in debt, the rise in interest rates and certain international trade tensions is a source of uncertainty, but the signs are generally positive for the economy and for household wealth. The United States are home to 41% of the world’s dollar millionaires. And the number of UHNWI with over $50 million is around four times higher in the US than in the country taking second place, China.

Investors carried out a total of $375.6 billion worth of real estate transactions over $10 million in 2017, representing a drop of 8% year-on-year. This slowdown in activity refl ects a downwards revision in prices throughout the year in major cities in the United States. This has not prevented market indicators from being extremely positive in the short term in the midst of the various reforms - namely tax reforms - unleashed since the election of Donald Trump.

Accordingly, in the second quarter of 2018, the United States posted annualised growth of 4.1% while unemployment stood at close to 4%, i.e. almost full employment. The profi ts of major corporations have spiked more than 20% year-onyear. Apple, for example, has seen its market capitalisation cross the symbolic threshold of $1,000 billion.

This is not yet grounds for euphoria since at the same time public revenue has fallen by a third in one year. As a result, the budget defi cit has risen to $779 billion under the impact of increased military and national security expenditure and this fall in public revenue. It now stands at 3.9% of GDP compared with 3.5% in 2017, according to fi gures published in October 2018 by the US Treasury. The spectre of overheating therefore looms over the US economy, with the rise in interest rates being the main indicator.

New York posted a 7% increase in its UHNWI population in 2017 (rising to 8,865). Although is a respectable performance, it marks the lowest level of growth out of the 10 cities with the highest number of UHNWI (with Hong Kong in fi rst place, home to 10,010 UHNWI, a 31% increase year-on-year).

The 4,583 UHNWI fi nanciers on Wall Street, although a modest group in size, possess $607 billion between them, which is an estimated fortune of $132 million per person. 91.5% of these success stories are those of self-made men and women, with an average age of 60.8.

The luxury real estate market is fl ourishing coast to coast. Florida, North Carolina, and certain cities such as Denver (Colorado), Monterey (California), Seattle (Washington) and Nashville (Tennessee) saw prices rise by between 13% and 20% year-on-year. The United States also represents 5 of the top 10 cities worldwide in terms of numbers of UHNWI, with New York, Los Angeles, Chicago, San Francisco and Washington.

The wealth of Russian households increased rapidly in the early years of the 20th century, buoyed by the prices of raw materials, with oil and gas in the lead. Between 2000 and 2007, wealth per adult increased eightfold. However, since 2007, growth was slower and unequal, with the rouble falling from USD 25 in 2007 to USD 34 in 2014, and to USD 63 in 2018! Average wealth per adult rose from USD 2,940 in 2000 to USD 19,997 by mid-2018, with a current level below that of 2007.

The quality of data on public and private-sector fi nancial health in Russia appears to be “contrastive”, according to Crédit Suisse, which estimates that the upper decile of wealth-holders possess 82% of all of the country's household wealth (compared with 77% in 2017). This high level surpasses even the United States (76%), a country which nonetheless has one of the most concentrated distributions of wealth among the advanced nations.

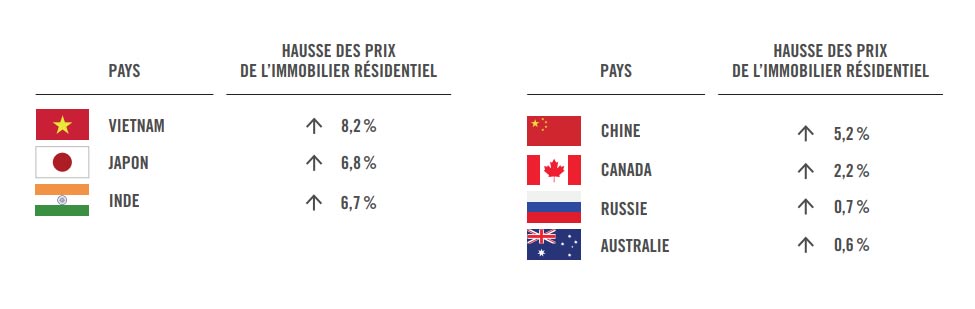

The high concentration of wealth in Russia is also refl ected in the fact that the country is home to 74 USD billionaires. Aft er 3 years of continued decline in the price of high-end real estate in Russia between the end of 2014 and the end of 2017 (a 55% fall on average in well-heeled Moscow neighbourhoods), 2018 marked the end of this decline with average price increases in the order of 0.7%. In the luxury real estate sector, Russian clients continue to have a strong presence internationally, more in terms of sales rather than purchases in Europe since 2013/2014.

The Asian continent has witnessed the arrival onto its real estate market of increasing capital fl ows, both local and global. This competition for the acquisition of assets on the major Asian markets reached unprecedented levels in 2017. With base rates remaining low and sovereign debt yields showing no sign of an increase, pressure on prices is growing, particularly for commercial and industrial real estate.

The golden era of guaranteed 20% annual returns is over, and many property owners are therefore reticent about selling due to concerns that they will be unable to fi nd a better way to reinvest their capital. In China, residential real estate is no longer the best route to guaranteed profi ts, as margins have fallen considerably in recent years.

Indeed, capital gains have fallen from around 20-30% ten years ago to 0-5% today. This is one of the main reasons Chinese investors are drawn to international markets, where returns are signifi cantly higher. The luxury real estate market is fl agging with a more moderate increase in prices in 2018 at around 5.2%.

In Vietnam, incontestably one of the Asian countries most in the limelight since 2016, foreign investors are turning towards residential real estate, where demand is both strong and growing. The first groups of investors, who entered the Vietnamese market ten years ago, are now being rewarded for their patience with capital gains of 50-60%. Another market returning to the international scene is Japan: residential property in Tokyo has increased in strength due to investors who are turning from commercial real estate in search of a sector with more stable returns (around 4% per year).

The wealth of South African households greatly increased prior to the 2008 global crisis, rising from USD 9,560 in 2000 to USD 25,280 in 2007. The country has not yet returned to pre-crisis wealth levels, although wealth has increased by 26% in USD since 2015. This is partly due to the strengthening of the South African Rand, however, correcting for its increase, the rise is still 13%. This reflects the acceleration in the growth of the country's economy in real terms, stimulated by the vibrancy of world trade observed in recent years.

Personal wealth is principally composed of fi nancial assets, representing 66% of household portfolios, with the relatively low real estate prices. South Africa's wealth distribution is similar to the global average, with estimations from Crédit Suisse reporting 61,000 South Africans within the top 1% of global wealth-holders, and 50,000 US dollar millionaires. Within this context, following a period of major price rises until 2016, the high-end real estate market has been experiencing a downwards correction since the beginning of 2017.

Weakened by repeated political and economic crises, Brazil has experienced serious difficulties in recent years. Wealth per adult fell by 36% since 2011 in US dollars. Increases in the Real during this period were largely due to infl ation, which stood at 4.56% year-on-year as at the end of October 2018. The unemployment rate was 12% in mid-2018 and Brazilian GDP is slated to rise by just 1.5% this year.

Brazilians traditionally have a particularly attachment to real estate, and notably land, which is seen as a hedge against infl ation. However, inequality remains relatively high, with Crédit Suisse estimating that 1% of Brazilians possess 43% of the nation's wealth. This relatively high level of inequality refl ects a persistent division between the “formal” and “informal” sectors of the economy.

The election of a former military figure, Jair Bolsonaro, as Brazil's new leader on 28 October 2018 is being carefully watched by international observers. Mr Bolsonaro made the fi ght against corruption and economic stimulus his main campaign pledges. Aft er a fall of over 40% in real estate prices since 2016, the market fell slightly in 2018, by 3.3%.

More news

Perspective

03/04/2024

Market analysis

07/02/2024

Perspective

18/12/2023

Perspective

29/11/2023

firm favourite

17/10/2023