Market analysis

20/01/2021

Despite a pause during the first lockdown, 2020 was a new record year from the point of view of luxury real estate. At national level, the 8 weeks of lockdown were erased by the dynamism that emerged from refocusing on what is important: well-being at home, whether at a primary residence or or second home.

Luxury real estate proved its safe haven value by doing more than just weathering the crisis: it boldly continued to grow. The purchasing power of the wealthiest was spared by the crisis and enabled the property market (and in particular the second home market) to thrive, despite insignificant foreign demand.

As such, the property market on the Basque Coast, and more specifically the ‘premium’ segment, recorded excellent performance. Running counter to western economies and industries, Basque upmarket real estate appreciated in value due to the combination of several phenomena:

“This new demand has resulted in a 100% increase in our online traffic, with 50% more requests for information and 30% more sales,” explains Philippe Thomine Desmazures, Director of BARNES Basque Coast. “Furthermore, demand, which is generally more active with the fine weather, only fell slightly in autumn and with the arrival of winter”.

Supply generally comes from the rule of 4: divorce, moving home, debts and death. “We did not (luckily!) see an increase in any of these factors, meaning that supply was relatively stable throughout the year. A desire for greenery and the draw of substantial added value made many think about selling their property in the most sought-after areas (the whole coast, Anglet-Biarritz-Bidart-Guethary and St-Jean-de-Luz-Ciboure), to move to the nearby countryside” says Philippe Thomine Desmazures.

This game of musical chairs benefits the market in the nearby ‘hinterland’ and in Bayonne, which offers a more urban lifestyle than on the coast but at much more appealing prices (30% less costly than Biarritz). Properties that have been on the market for a long time because of an unusual layout, a prohibitive defect, or a price that is too high, still find buyers, due to a lack of choice, and with an excitement that is still palpable.

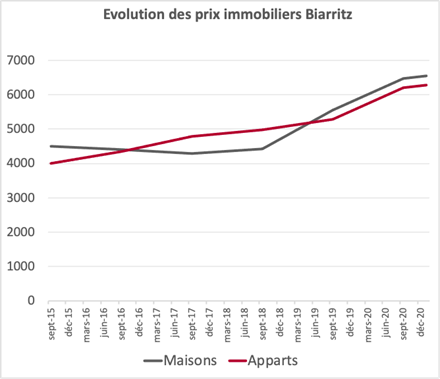

The consequence? Previous crises have shown a clear correlation between economic life and the property market. It would therefore have been logical to see a downturn in prices. Unlike the predictions of the more cautious, the market has not stabilised, but instead has seen a clear upward trend in prices this year, irrespective of the town or city. This situation is out of sync with other areas of life which are suffering in the midst of the pandemic. “In concrete terms, in our niche market, we have seen our average sale price jump from €1.1M to €1.4M — a rise of 27%” adds Philippe Thomine Desmazures.

|

Price of properties sold in 2020 |

|

|---|---|

|

Number of sales |

Price |

|

9 |

Over 3 million |

|

10 |

1,5 to 3 million |

|

18 |

1 to 1,5 million |

|

24 |

500.000 to 1 million |

|

4 |

less than 500,000 euros |

The desire for a new lifestyle, the need for well-being at home and the focus on living environment (less travel and fewer restaurants may have positive consequences), the work-from-home boom, the spread of the COVID vaccine and a calmer international geopolitical climate for the past 4 years are all small signals that generate a certain amount of confidence. Furthermore, interest rates are stable or falling very slightly, even if, paradoxically, banks are making it harder to obtain credit.

Although economies have been weakened by the health measures put in place and the decline in tourism, the aeronautical industry, the hotel and catering industry, and the financial markets have curiously almost returned to their highest levels since 2008. This makes the idea of stock market investments less attractive at these record levels, which are more than ever disconnected from the real economy.

“A buyer may therefore be tempted to finance an acquisition on the Basque Coast by selling their stock market assets at an inflated price,” analyses Philippe Thomine Desmazures. “The Parisian market is a good indicator when it comes to anticipating the market on the Basque Coast as new buyers generally tend to be selling their property. In this second home or new primary residence market, more than 50% of our clients are from Paris or the Parisian region,” he adds. At a slightly less sustained pace than between 2016 and 2019, the Paris property market has continued to appreciate to increase the profit of transactions. Given the record prices in Paris, the proceeds of these sales allows for a considerable budget, which is continuing to increase.

Apartments in the city centre of Biarritz and Saint-Jean-de-Luz in good condition but without a sea view are selling at nearly €10,000/sq.m. Stunning sea views sell for more than €20,000/sq.m if combined with outdoor spaces and a location close to the centre with a garage in an upmarket building, with a record sale of €40,000/sq.m in 2020 at the Villa Belza. The ‘glass ceiling’ is constantly rising.

More than ever in 2021, property must be a key investment as a safe haven value, both literally and figuratively. “As a property agent, our duty to advise often encourages caution. And this caution has led us to give careful advice since the beginning of this property frenzy on the Basque Coast: “Prices are not open-ended”, as I’ve been repeating for 2 years. They may not be open-ended, it’s true, but they keep rising” concludes Philippe Thomine Desmazures.

More news

Real Estate & Art de Vivre

14/11/2025

Perspective

03/11/2025

Perspective

24/10/2025

News

07/10/2025

Perspective

19/09/2025