BARNES FAMILY OFFICE by Côme combines the breadth of real estate opportunities with financial expertise to shelter the growth of your assets.

BARNES is well aware that beautiful stone is at the heart of wealth, but also that wealth takes many forms, to pursue many dreams and ensure lasting success.

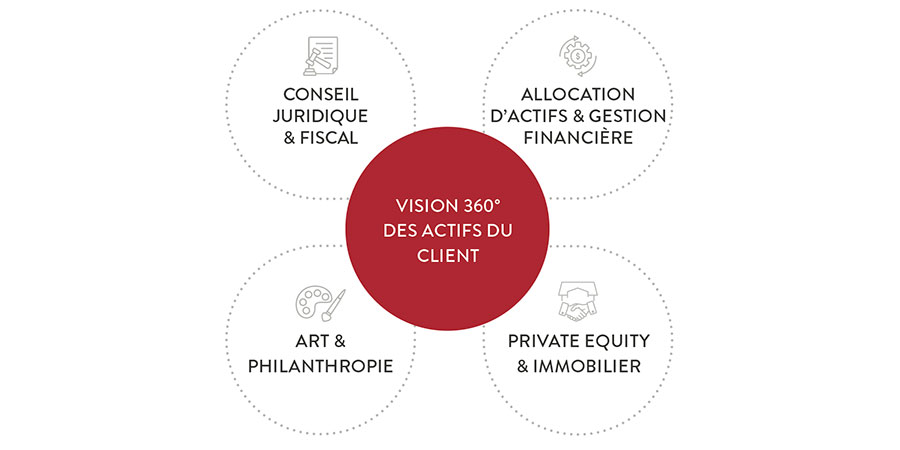

BARNES FAMILY OFFICE by Côme offers its customers a comprehensive and distinctive range of patrimonial services. In the world of ï¬nance, our unrivalled knowledge of real estate enables us to advise and identiï¬er a variety of opportunities for our customers: professional real estate (offices, shops, buildings), passion real estate (vineyards, hotel residences, hunting estates, stud farms, golf courses, castles, mountains, sea, countryside), personal real estate in France and abroad.

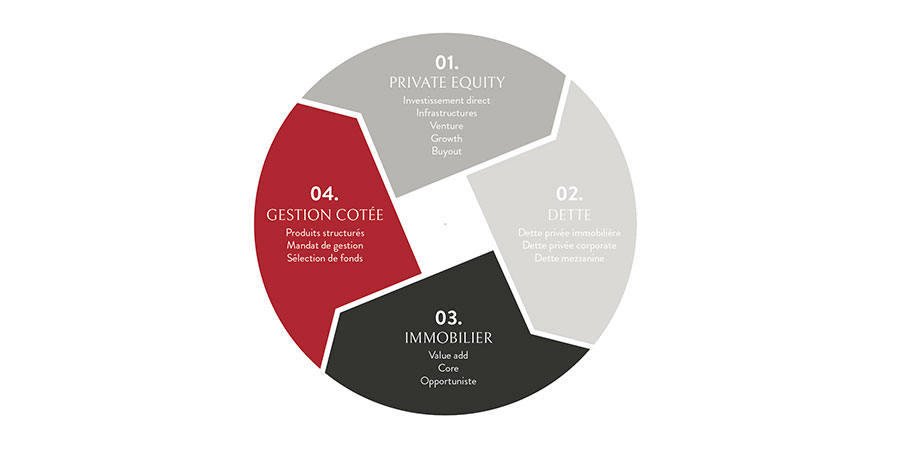

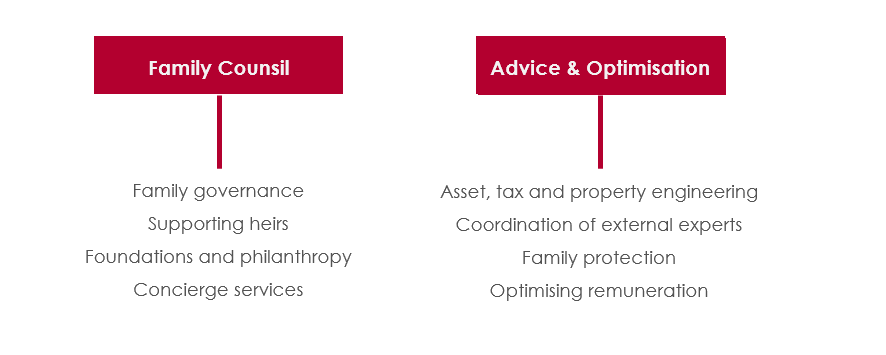

Through our management services and listed and unlisted investments, our family officers forge new links between real estate, works of art, collectors' items and ï¬nancial assets. They advise and support our customers in all aspects of their assets and their growth, in terms of analysis and advice, management and reporting, administrative follow-up, compliance, and relations with all stakeholders (lawyers, insurers, notaries, bankers, etc.).

BARNES FAMILY OFFICE by Côme was born of the meeting between BARNES and Côme, leading players in real estate, lifestyle and ï¬nance.

A multi-family office founded in 2016, ranked year after year in the 'Excellent' category by Décideurs Magazine and Leaders League, Côme, Le Family Office has many entrepreneurial-minded customer families. Drawing on its expertise in wealth and ï¬scal advisory services, ï¬nancial management, real estate investments and private equity, Côme plans and pilots everything that needs to be done to grow assets and nurture its customers' ambitions.

From its offices in Paris, Marseille and New York, Côme absorbs the world's major and long-lasting trends, without ever forgetting to put down roots in the regions. Numerous exchanges take place between its members and partners to bring out shared opportunities, in the form of ï¬nancial club deals - via direct equity investments in growth companies - and real estate.